Practicing law is hard enough; running a law firm is harder. Let’s be honest, most lawyers would rather focus on the practice of law rather than law firm management. But law firms need cash to survive and grow – even more so for firms that rely heavily on contingency fees. They often find themselves in feast or famine mode: flush with cash when a big case comes in and then riding out the dry spells in between.

The reality is that takes money to make money. Studies consistently show that investment in key areas such as technology and marketing can make or break a small firm. But those investments require capital. And capital can be hard to come by for smaller firms. So what are your options?

Let’s take a look. Each one of these carries different risks and rewards.

| Product | Pros | Cons |

|---|---|---|

| Personal Savings | The cheapest way to finance your business. It leaves you debt-free and not dependent upon outside sources. | It can drain your personal savings and leave you personally exposed. |

| Credit Cards | Fast and easy access to funds. | High rates & limited flexibility. |

| Bank Loan | Competitive rates and flexible line of credit products. | Difficult for small firms to obtain. Banks typically do not value potential attorneys’ fees. May require pledge of real property. |

| Online Lenders | Fast and easy access to funds. | High rates and limited flexibility. Weekly or monthly amortized payments. |

| Non-recourse case funding | Cash upfront in exchange for a share of your fees on a given case(s). Sort of like payday lending for lawyers. No payback if you lose the case. | Extremely high rates (avg. of 300-300% return). Lenders pick the cases most likely to provide returns. |

Is there another option?

That’s where Bridgehead comes in. Our sole purpose is to provide flexible funding to small law firms. Here’s how we do that:

- We know your business and value your cases. Unlike traditional or online lenders, we’re trained to recognize the value of your entire case portfolio.

- More affordable rates. While not as competitive as highly secured bank loans, our rates are more affordable than high-interest credit cards, and significantly more so than non-recourse funding. Better yet, rates can decrease over time for our better clients. When you succeed, we succeed.

- Right-sized loans. Rather than saddle your firm with more debt than you need, we encourage firms to right-size their loan. Take only what you need and come back for more only when you need it.

- Repayment tied to the reality of your practice. Monthly payments are interest-only, and principal repayment is timed to when you receive fees.

- No penalty for pre-payment. Pay back anytime without penalty.

- No pledge of real property. We don’t attach our loans to your home or business property.

- Long term relationship lender. Rates and products vary over time. We aim to be your long-term lender of choice.

- Personalized lending. We offer flexible terms and personalized customer service.

Ready to get started? Reach out anytime.

www.bridgeheadlegalcapital.com

(980) 288-4530

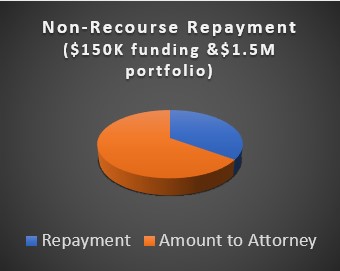

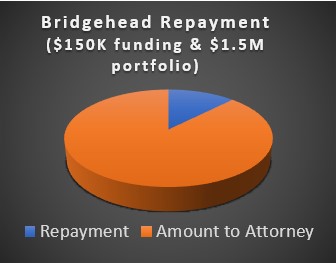

Non-Recourse Funding v. Law Firm Portfolio Lending

Non-recourse loans look attractive at first. You get cash up front and only pay back if you win. For some cases (and some firms), it makes sense to transfer both the risk and the reward.

But let’s look at the bigger picture. Investors typically fund those cases most likely to provide a solid level of return. Add in the high rates and you end up turning over a hefty portion of your fees on your best cases. In the end, that significantly reduces the amount you bring back into your firm.

Law firm lending, in contrast, utilizes the value of your entire case portfolio. We see the value in all of your cases and your firm as a whole. You still get funds upfront. But you pay back a more reasonable rate over time – making principal payments each time you collect fees. In the end, you take home a much larger percentage of the fees your firm has earned.